Agricultural Fumigants Market

Agricultural Fumigants Market - Global Industry Assessment & Forecast

Segments Covered

By Product Type Methyl bromide, Phosphine, Chloropicrin, Metam Sodium, 1,3-Dichloropropene, Other Product Types ( propylene oxide, sulfuryl fluoride, carbon dioxide, and dazomet)

By Crop Type Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Other Crop Types

By Pest Control Method Vacuum Chamber Fumigation, Tarpaulin, Structural, Non-tarp Fumigation by Injection, Other Pest Control Methods (Hotspot Fumigation, Vehicle Fumigation: Railroad Car, Truck, or Van, Farm Grain Storage Fumigation, and Rodent Burrow Fumigation)

By Application Soil, Warehouse

By Form Solid , Liquid , Gas

By Function Insecticides , Fungicides , Nematicides , Herbicides

By Region North America, Europe, Asia Pacific , Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 2.3 Billion | |

| USD 3.1 Billion | |

| 4.50% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

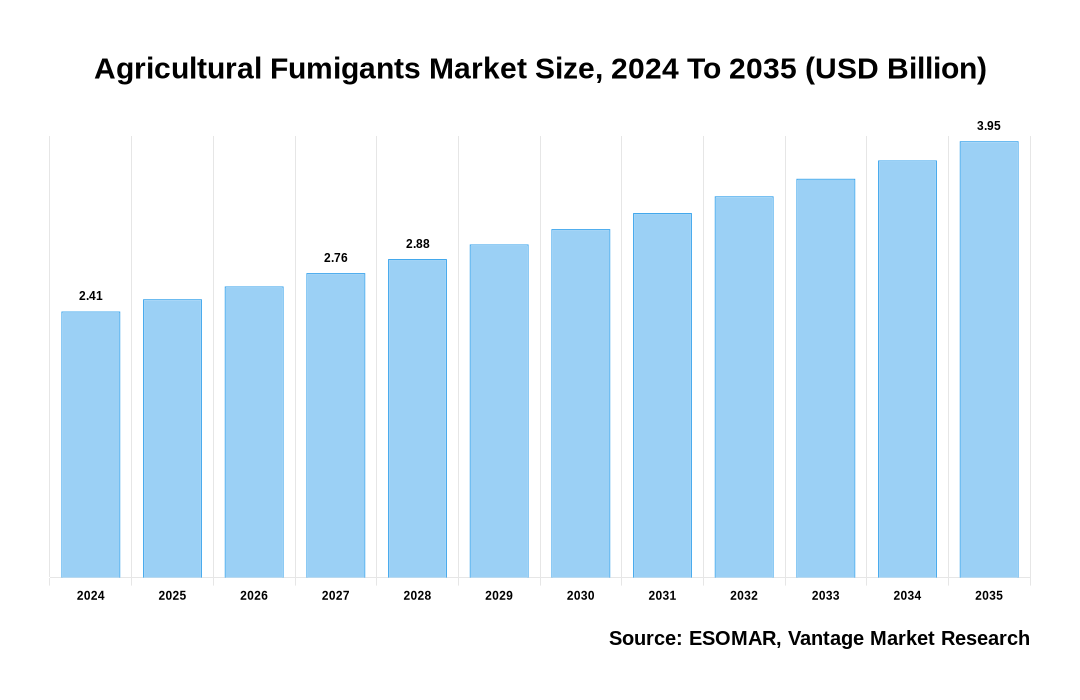

The global Agricultural Fumigants Market is valued at USD 2.3 Billion in 2022 and is projected to reach a value of USD 3.1 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 4.50% between 2023 and 2030.

Premium Insights

The market for Agricultural Fumigants is being driven by rapid technical improvements in the agricultural industry, growing concerns about post-harvest losses, and a change to more advanced farming techniques that have enhanced yields. Fumigants can assist reduce storage loss when used during storage. As a result, the demand for fumigants is anticipated to rise given that using them to cut post-harvest losses is an efficient and cost-effective strategy.

Agricultural Fumigants Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Agricultural Fumigants Market

- The Agricultural Fumigants market is vital, as the FAO predicts a 70% increase in agricultural productivity by 2050 to meet global food demand. Fumigants protect crops, reduce post-harvest losses, and enhance food security, making them crucial for sustainable agriculture and minimizing food waste and environmental impact.

- North America generated more than 40.60% of revenue share in 2022

- Asia Pacific is expected to grow at the quickest rate from 2023 to 2030

- Phosphine segment accounted for the largest market growth. It contributed over 38.5% of the total revenue share in 2022

- Cereals & grains segment revealed the most significant market growth, contributing more than 43.5% of the total revenue share in 2022

- Structural segment accounts for largest revenue of 37.8% in 2022

- Warehouse segment will dominate the market will market share of 52.8% in 2022

- Gas segment will account for 49.8% market share in 2022 for Agricultural Fumigants market

- Insecticides will dominate the market with market share of 42.5% in 2022

Economic Insights

The Agricultural Fumigants has grown significantly. Crop values are crucial, especially for high-value crops like fruits and vegetables, which account for more than 40% of the money generated by the global market for Agricultural Fumigants. Costs associated with regulatory compliance, notably with safety and environmental regulations, account for about 15% of the overall costs incurred by fumigant companies. Additionally, improvements in fumigant technology need an annual R&D expenditure of about 8% of the market's overall value. With more consumers demanding pesticide-free produce, sustainability issues are becoming more and more important. As a result, there has been a 10% increase in demand for eco-friendly fumigant substitutes.

Report Coverage & Deliverables

Get Access Now

Top Market Trends

- Growing demand for food: By 2050, there will be 9.8 billion people in the world, which will place a burden on food supply. Fumigants can aid in the protection of crops from pests and diseases, hence boosting yields and lowering food losses.

- Increased awareness of the benefits of fumigation: Farmers are becoming more knowledgeable about the advantages of fumigation, such as its capacity to reduce post-harvest losses, boost crop yields, and manage pests and illnesses.

- Development of new and improved fumigants: Numerous enhanced fumigants that are more efficient and less damaging to the environment are currently being developed. As a result, farmers are finding fumigation to be a more appealing alternative.

- Increasing demand for bio-based fumigants: Traditional fumigants are not considered to be as environmentally benign as bio-based fumigants, which are produced from natural sources. The demand for bio-based fumigants in the agricultural industry is being driven by this.

- Development of new fumigant delivery systems: Fumigant delivery methods are being improved upon to be more effective and efficient. As a result, farmers are finding fumigation to be a more appealing alternative.

Market Segmentation

Agricultural Fumigants The global Agricultural Fumigants market can be categorized into Product Type, Crop Type, Pest Control Method, Application, Form , Function, Region. The Agricultural Fumigants market can be categorized into Methyl bromide, Phosphine, Chloropicrin, Metam Sodium, 1,3-Dichloropropene, Other Product Types ( propylene oxide, sulfuryl fluoride, carbon dioxide, and dazomet) based on Product Type. The Agricultural Fumigants market can be categorized into Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Other Crop Types based on Crop Type. The Agricultural Fumigants market can be categorized into Vacuum Chamber Fumigation, Tarpaulin, Structural, Non-tarp Fumigation by Injection, Other Pest Control Methods (Hotspot Fumigation, Vehicle Fumigation: Railroad Car, Truck, or Van, Farm Grain Storage Fumigation, and Rodent Burrow Fumigation) based on Pest Control Method. The Agricultural Fumigants market can be categorized into Soil, Warehouse based on Application. The Agricultural Fumigants market can be categorized into Solid , Liquid , Gas based on Form . The Agricultural Fumigants market can be categorized into Insecticides , Fungicides , Nematicides , Herbicides based on Function. The Agricultural Fumigants market can be categorized into North America, Europe, Asia Pacific , Latin America, Middle East & Africa based on Region.

Based on Product Type

Phosphine holds the largest share

The Agricultural Fumigants market is expected to be dominated by the Phosphine segment due to its efficiency against a variety of pests, including insects, rodents, and nematodes. Its standing as a trusted option for farmers also contributes to its popularity. The adaptability of phosphine, which comes in a variety of formulations, makes it suitable for a range of applications. The fact that it is affordable further solidifies its position as a cost-effective alternative and its domination in the Agricultural Fumigants market.

Based on Crop type

Cereals & grains will dominate the market during Forecast Period

The Agricultural Fumigants market is anticipated to be dominated by the cereals & grains segment due to its link with important food crops that are susceptible to a variety of pests, including insects, rodents, and nematodes. Fumigants are an efficient method for preventing insect infestations and protecting these high-yield crops from harm.

Based on Pest control method

Structural will account for largest market share

In terms of pest control methods, structural are anticipated to hold the greatest market share for Agricultural Fumigants due to its efficiency in dealing with structural pests, its applicability to treat large areas like warehouses and silos, and its favorable reputation for safety among farmers. Because of the serious damage that these pests pose to stored products and crops, structural fumigation is a crucial pest management strategy.

Based on Application

Warehouse lead the market in 2022

The warehouse category leads the market and have significant market share because of storage facilities, fumigants prove to be a useful tool for pest control, protecting stored goods from potential harm. Several factors, including the growing international traffic in agricultural and food items, which is anticipated to increase the demand for warehouse fumigation in the coming years, support the rise of the warehouse application. Furthermore, warehouse fumigation's comparatively low cost makes it a practical option for companies, thus strengthening its hegemony in the Agricultural Fumigants market.

Based on Form

Gas segment will dominate the market

Gas form will dominate the Agricultural Fumigants market due to gases' unrivaled efficacy as fumigants. The great penetrating power of gases allows them to quickly destroy pests by entering even the most hidden nooks and crevices where they like to hide. The expected dominance of the gas segment in the Agricultural Fumigants market is supported by a number of compelling factors, including its ease of use, generally safe usage profile, and wide-spread acceptance among farmers, underscoring its position as the most efficient and preferred form of fumigants for pest control in agricultural settings.

Based on Function

Insecticides will dominate the market

The insecticides segment is expected to lead the Agricultural Fumigants market because insects are the most frequent crop-damaging pests. Fumigants have a variety of effects on insects, including direct annihilation, disruption of growth and development, and decreased attractiveness to other insects. Numerous variables, such as the rising worldwide population and the need to increase food production, which are predicted to fuel insecticide demand.

Based on Region

North America will lead the market

North America is expected to dominate the market for Agricultural Fumigants because the area has a substantial agricultural industry that accounts for a sizeable amount of the world's food production, supporting its status as a major actor. In addition, North America predicts a rise in food demand as a result of an expanding population and rising consumer wealth, underscoring its market dominance. This position is strengthened further by a well-established infrastructure for the manufacturing and distribution of Agricultural Fumigants, which consists of a vast network of fumigation firms and a strong regulatory framework guaranteeing the safe and effective use of fumigants.

Competitive Landscape

The global Agricultural Fumigants market is fragmented, including a diverse array of the presence of several key players, ranging from established multinational companies, niche specialists are active participants, each bringing unique strengths and offerings to the market. Market leaders often distinguish themselves through extensive research and development efforts, innovation in fumigant formulations, and strategic partnerships. Additionally, sustainability and environmentally-friendly solutions are becoming focal points, driving competition towards eco-conscious alternatives.

The players in the global Agricultural Fumigants market include DowDuPont, Amvac Chemical Corporation, Syngenta AG, UPL Group, Detia Degesch GmbH, ADAMA Agricultural Solution Ltd, BASF SE, Cytec Solvay Group, FMC Corporation, Fumigation Services, Ikeda Kogyo Co. Ltd, Industrial Fumigation Company, Isagro SpA, Lanxess, Reddick Fumigants LLC, Trical Inc., TriEst Ag Group Inc., VFC, Industrial Fumigation Company among others.

Recent Market Developments

- January 2022: To improve its grain orientation strategy in Brazil, UPL Ltd struck an arrangement in which Bunge Ltd would buy a 33% stake in Sinagro.

Segmentation of the Global Agricultural Fumigants Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Product Type

By Crop Type

By Pest Control Method

By Application

By Form

By Function

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Agricultural Fumigants in terms of revenue?

-

The global Agricultural Fumigants valued at USD 2.3 Billion in 2022 and is expected to reach USD 3.1 Billion in 2030 growing at a CAGR of 4.50%.

Which are the prominent players in the market?

-

The prominent players in the market are DowDuPont, Amvac Chemical Corporation, Syngenta AG, UPL Group, Detia Degesch GmbH, ADAMA Agricultural Solution Ltd, BASF SE, Cytec Solvay Group, FMC Corporation, Fumigation Services, Ikeda Kogyo Co. Ltd, Industrial Fumigation Company, Isagro SpA, Lanxess, Reddick Fumigants LLC, Trical Inc., TriEst Ag Group Inc., VFC, Industrial Fumigation Company .

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 4.50% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Agricultural Fumigants include

- Growing usage of fumigants for the production and storgae of cereals

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Agricultural Fumigants in 2022.