U.S. Eubiotics Market

U.S. Eubiotics Market - Global Industry Assessment & Forecast

Segments Covered

By Product Probiotics, Prebiotics, Organic acids, Essential oils, Others

By Livestock Poultry, Swine, Ruminants, Aquatic animals, Others

By Function Nutrition & Gut Health, Yield, Immunity, Production

By Form Dry, Liquid

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 1105 Million | |

| USD 2135.2 Million | |

| 7.3% | |

| XX | |

| XX |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

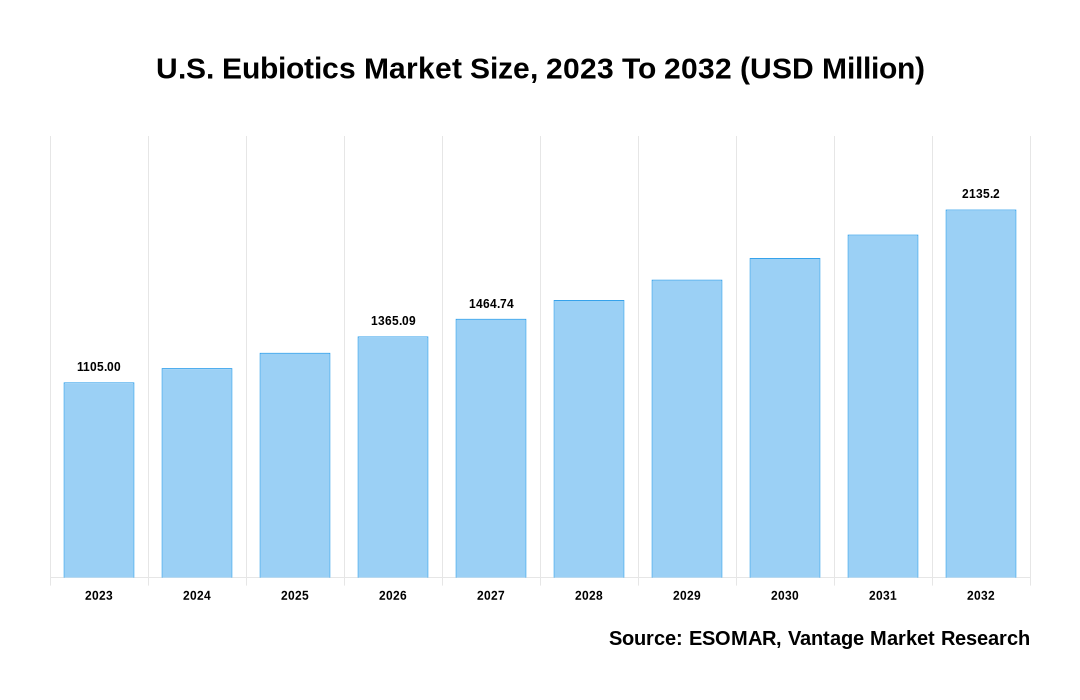

The U.S. Eubiotics Market is valued at USD 1105 Million in 2023 and is projected to reach a value of USD 2135.2 Million by 2032 at a CAGR (Compound Annual Growth Rate) of 7.3% between 2024 and 2032.

Key highlights of U.S. Eubiotics Market

- In 2023, the probiotics segment accounted for the largest revenue share of 44.9% in U.S. Eubiotics Market

- The poultry segment asserted its dominance and capturing the largest revenue share of 39.7% in 2023

- The Nutrition & Gut Health segment led the U.S. Eubiotics market with revenue share of 44.8% in 2023

- In 2023, the dry segment accounted for the largest revenue share of 60.1% in U.S. Eubiotics Market

- Increasing collaboration for developing R&D activities is fueling the growth of the U.S. Eubiotics Market. For instance, Novus International has entered into a collaboration with Agrivida, a biotechnology firm based in the United States, to conduct joint research and development endeavors. This partnership aims to investigate avenues for novel product innovations.

U.S. Eubiotics Market Size, 2023 To 2032 (USD Million)

AI (GPT) is here !!! Ask questions about U.S. Eubiotics Market

U.S. Eubiotics Market: Overview

Rising consumer awareness of gastrointestinal health and growing requirement for natural alternatives to conventional additives because of its growing concerns over antibiotic resistance in livestock production is driving the growth of U.S. Eubiotics market. Eubiotics such as probiotics, essential oils, feed additives, and prebiotics, are gaining traction in animal nutrition and food production because of its ability to improve nutrient assimilation, gut health, and immune support. Consumers are majorly focusing towards natural, organic, and sustainable alternatives, aligning with trends in sustainable agriculture and food safety. However, market expansion can face hurdles such as consumer education gaps and regulatory compliance challenges. To address these, manufacturers are focusing on product differentiation, marketing campaigns, and consumer education initiatives. Key players like DuPont de Nemours, Inc., Chr. Hansen Holding A/S, Novozymes A/S, Lallemand Inc., and Kemin Industries, Inc., offer a diverse range of eubiotics products and health enhancement solutions for animals, driving innovation and market growth.

The U.S. Eubiotics market can be categorized as Product, Livestock, Function, and Form.

| Parameter | Details |

|---|---|

| Segments Covered |

By Product

By Livestock

By Function

By Form

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Eubiotics Market: Product Overview

In 2023, Probiotics segment accounted to have largest revenue share of 44.9% in the U.S. Eubiotics Market. The Product segment is divided into Probiotics, Prebiotics, Organic acids, Essential oils, and Others. Probiotic microorganisms help in reducing the risk of gastrointestinal disorders by overcoming harmful pathogens, controlling the gut and maintaining gut integrity. With the help of produced enzymes and metabolites, these probiotics support the breakdown of complex nutrients which can be useful in improving nutrient absorption and utilization. Probiotics also have immunomodulatory effects, meaning they boost the organism's defenses against infections and environmental stressors by energizing the immune system. In young animals, this immune-stimulating ability is especially helpful since it promotes healthy growth and resistance to disease. Probiotics provide advantages for the immune system, the digestive system, and breeding stock reproduction.

U.S. Eubiotics Market: Livestock Overview

In 2023, the Poultry segment held a significant revenue share of 39.7% in U.S. Eubiotics Market. The Livestock segment covers Poultry, Swine, Ruminants, Aquatic animals, and Others. Primarily raised for meat, eggs, and other products, poultry production stands as a cornerstone of the livestock industry. Chickens, the most prevalent poultry type, valued for their versatility and efficient feed conversion, serve dual purposes as broilers for meat and layers for eggs, with specialized breeds and production systems tailored accordingly. Turkeys, another essential segment, particularly prominent during festive occasions, are prized for their flavorful meat and efficient growth, paralleling the production efficiency of broiler chickens. Ducks, though less common in some regions, hold significance, especially in Asia, renowned for their rich-flavored meat and nutritional value of eggs. Alongside chickens, turkeys, and ducks, other poultry types like geese, quails, and guinea fowl cater to niche markets, offering diverse options for producers and consumers, reflecting various culinary preferences and cultural traditions.

U.S. Eubiotics Market: Function Overview

The Nutrition & Gut Health segment asserted a maximum revenue share of 44.8% in 2023. The Function segment is divided into Nutrition & Gut Health, Yield, Immunity, and Production. Enhancing nutrition and gut health is a revolutionizing strategy encompassing various elements such as supporting beneficial gut microbiota, formulating a balanced diet, and mitigating stressors that disrupt digestive functions. Animals that eat a balanced diet maintain their gastrointestinal tracts and acquire the vital nutrients they need for development, reproduction, and maintenance. Dietal fibers, prebiotics, and probiotics are essential elements of a gut-healthy diet because they promote the growth of good gut bacteria, facilitate digestion, and enhance nutrient absorption. Dietary fibers act as substrates for microbial fermentation, generating short-chain fatty acids vital for energy and gut health maintenance.

Key Trends

- Consumers are preferring natural and organic products due to health and environmental awareness. With the rising demand for natural compounds, various manufacturers are developing eubiotics products made from essential oils, plant extracts, and botanicals, reflecting a larger trend towards sustainable agriculture in the US.

- Rising awareness about gut health and overall well-being increases the interest in eubiotics that improve the immune and digestive systems of livestock. Consumers prefer meat and dairy from animals feed with eubiotic supplements, driving up demand for such products. This trend has made gut-focused eubiotics a significant sector in the functional feed additives market.

- Utilization of Genetic engineering and efficient fermentation techniques are providing potential growth opportunities in this market. Thus, the enhancement in manufacturing processes has experiencing a rapid growth in the U.S. Eubiotics industry.

Premium Insights

The regulatory framework governing the U.S. Eubiotics Market is pivotal, ensuring industry adherence to safety standards and protecting public health. Oversight from agencies like the USDA and FDA encompasses formulation, labeling, and marketing practices, crucial for compliance with regulations. Eubiotics are classified either as veterinary medications or animal feed additives, with FDA's CVM setting safety standards for feed additives. Products claiming therapeutic properties undergo rigorous FDA evaluation, necessitating adherence to GMP and extensive documentation. Regulatory evolution, driven by agencies like the FDA and USDA, responds to emerging issues such as antibiotic resistance, exemplified by measures like the Veterinary Feed Directive (VFD) mandating veterinary supervision and promoting alternatives like eubiotics in animal feed sector.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

Technological advancements in agriculture and animal Industry Drives the U.S. Eubiotics Market growth

Advancements in agriculture and animal husbandry technologies is a primary factor propelling the growth of the U.S. Eubiotics Market in recent years. Eubiotics are majorly utilized in enhancing animal health, optimizing feed efficiency, and reducing antibiotic usage. Precision farming and the use of digital techniques to precisely monitor animal health are some major driving forces in the growth of the U.S. Eubiotics Market. This technique enhances animal productivity and supports sustainable agricultural practices by minimizing resource wastage. Genetically modified eubiotics provide vast solution in bolstering animal immune systems, mitigating disorders, and minimizing reliance on conventional antibiotics. Additionally, progress in biotechnology facilitates the development of innovative prebiotics and organic acids with heightened efficacy and safety profiles, aligning with the evolving requirements of contemporary livestock production systems.

Increasing Focus on Environmentally Responsible Practices and Sustainable Agriculture propels the U.S. Eubiotics Market growth

The growth of the U.S. Eubiotics Market is significantly driven by a heightened emphasis on environmentally responsible practices and sustainable agriculture. Unlike conventional additions like antibiotics, which have hazards like antibiotic resistance and environmental pollution, eubiotics provide a sustainable way to reduce the environmental effect of animal production. Eubiotics help lower greenhouse gas emissions, waste outputs, and resource inputs in animal production by improving feed efficiency, encouraging gastrointestinal health, and optimizing nutrient consumption. With its emphasis on sustainability, the U.S. Eubiotics Market has a significant chance to spearhead the shift to food systems that are more robust and ecologically friendly. By implementing eubiotics, manufacturers of livestock and food can gain a competitive advantage in the market by meeting customer demands for ethically produced food while simultaneously improving the sustainability of their operations.

Competitive Landscape

The competitive environment is dominated by joint ventures, technology breakthroughs, and a common goal of meeting the changing needs of the US eubiotics market. For instance, In the competitive landscape of the U.S. Eubiotics Market, significant developments have emerged, shaping the industry dynamics. The strategic initiative to fulfill the growing demand for animal protein in the region is highlighted by Cargill and BASF's cooperation growth in feed enzyme development and distribution. On the other hand, Koninklijke DSM NV's acquisition of Midori USA Inc. underscores a focused approach towards targeted Eubiotics development, emphasizing improvements in environmental impact and animal health.

The key players in the U.S. Eubiotics market include - BASF, DSM, ADM, CHR. HANSEN, ADISSEO, Bionutrition, Evonik Industries, Cargill, Novus International among others.

Recent Market Developments

- In January 2023, Cargill and BASF have announced the expansion of their partnership in feed enzyme distribution and development to encompass the United States. The goal is to create a collaborative innovation pipeline to support the animal protein producers in the region who are grappling with the increasing demand for animal protein.

- In August 2022, Koninklijke DSM NV, a Dutch multinational corporation, has unveiled Symphiome, a eubiotic feed additive designed to promote optimal gut health, growth, welfare, and sustainability in poultry.

- In January 2023, Novus International partnered with Agrivida, a US-based biotechnology company, for R&D collaborations. Through this partnership, the company will explore possibilities in new product developments, which may drive the company's eubiotics business.

FAQ

Frequently Asked Question

What is the global demand for U.S. Eubiotics in terms of revenue?

-

The global U.S. Eubiotics valued at USD 1105 Million in 2023 and is expected to reach USD 2135.2 Million in 2032 growing at a CAGR of 7.3%.

Which are the prominent players in the market?

-

The prominent players in the market are BASF, DSM, ADM, CHR. HANSEN, ADISSEO, Bionutrition, Evonik Industries, Cargill, Novus International.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 7.3% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the U.S. Eubiotics include

Which region accounted for the largest share in the market?

-

XX was the leading regional segment of the U.S. Eubiotics in 2023.